FutureSmart℠: Join over 50,000 educators who are improving their students' financial literacy with our free program

FutureSmart helps your students

- understand their financial personalities

- discover the importance of budgeting

- learn how to save and manage day-to-day expenses

- explore different careers in finance

"*" indicates required fields

FutureSmart gives your students a critical head start.

You’ve seen the reports: young people don’t understand how to navigate the world of personal finance. The problem is, you don’t have the curriculum to teach them—or the time to implement it.

That’s why the MassMutual Foundation has partnered with EVERFI to develop FutureSmart℠: Financial Literacy for Middle School courses tailored to grades K-12. These engaging digital lessons are available to schools throughout the U.S. and Puerto Rico, absolutely free. FutureSmart has also been certified as meeting rigorous ESSA evidence standards.

In partnership with Mass Mutual Foundation

MassMutual Foundation’s FutureSmart interactive lessons help students learn how to:

- effectively manage their finances

- make sound money decisions

- become stewards of their financial futures

Always free. Trusted by 50,000+ educators across North America.

Using interactive exercises and real-life scenarios, MassMutual Foundation’s FutureSmart program empowers students to make sound financial decisions, effectively manage their finances, and take charge of their financial futures.

Course Snapshot

-

Target Grades

Grades 6-8

-

Curriculum

Economics, Business or Social Studies, Career Readiness

-

Lesson Time

25 Minutes/Activity, 3.5 Hours Total

Welcome Mayor!

Students are introduced to the course storyline and participate in their mayoral inauguration! Students also take a “Financial Personality Test,” and reflect on their own personal financial priorities, habits and mindsets.

Smart Shopping

Students learn the importance of budgeting as they help a character redecorate his room on a limited budget. Students engage in comparison-shopping methods to ultimately learn how to make smart choices about when and how to spend.

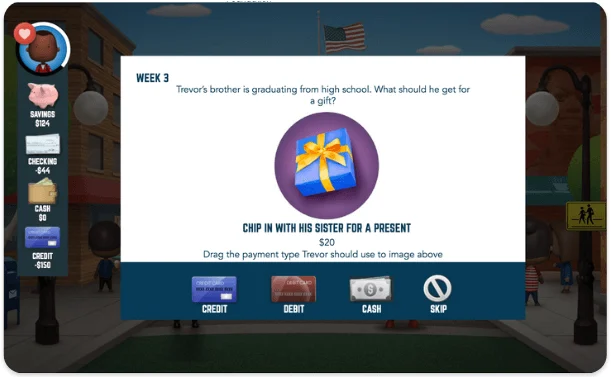

Ways to Pay

Students learn both the importance of saving and how to manage day-to-day expenses. Students help a character find a job, review his paycheck and credit card statement, and decide when to utilize different payment types.

Investing in You

Help a character explore different career path options and narrow her interests by examining required skills and interests, income potential, and education and training requirements. Students also explore ways to reduce out-of-pocket cost of higher education.

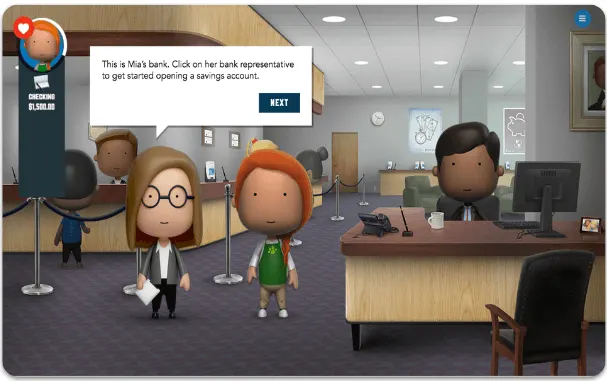

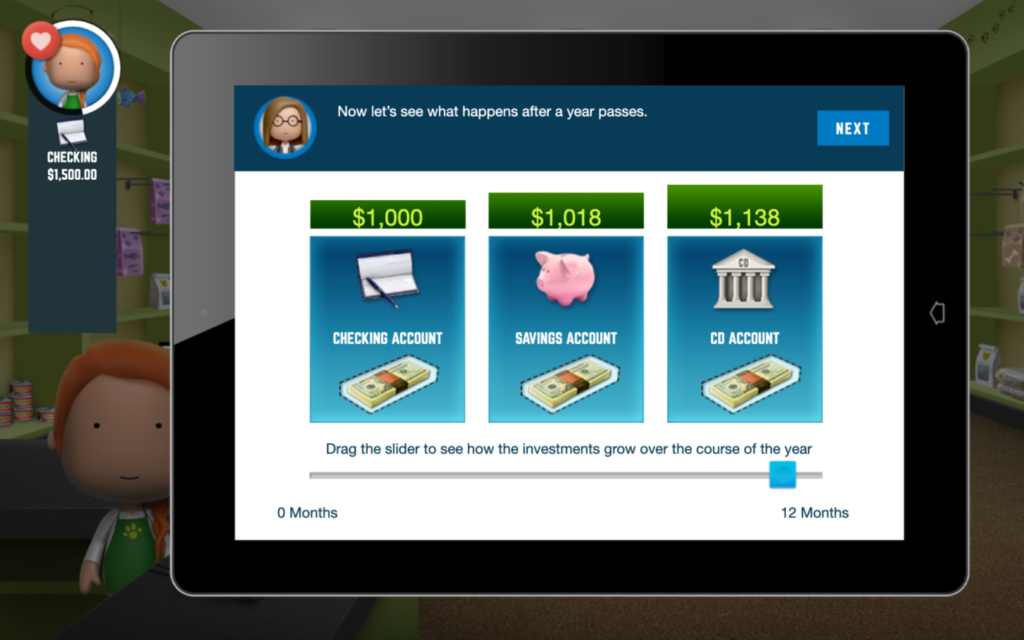

Growing a Business

Students learn all about business growth as they help a business owner with various tasks, such as calculating monthly profit and loss and strategizing how to save for new capital. They also learn how to open savings and checking accounts, grow money faster with a certificate deposit, and make monthly transaction decisions.

Your Financial Future

Students explore a “life simulation” and support a character in making important insurance and investment decisions. Through helping the character analyze and select different insurance policies, students get the chance to experience just how random, unexpected occurrences can lead to financial loss.

Build Your Blueprint

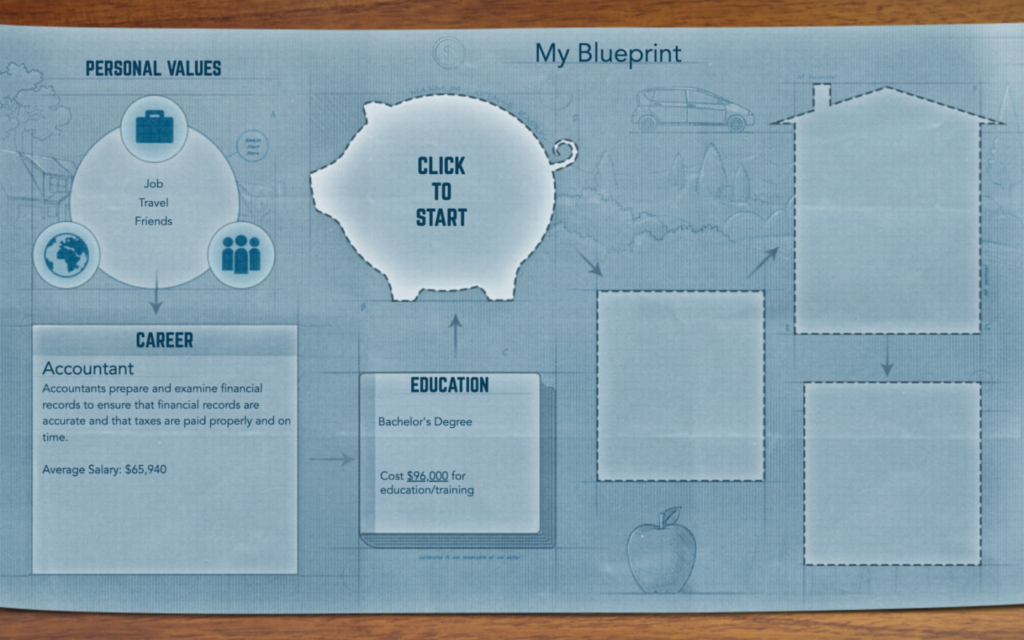

The course comes full circle in this final lesson, as students utilize their newfound knowledge to set their own financial goals and plans. Students create a portfolio piece, known as their “Blueprint,” which details future career interests, plans for higher education, and next action steps.

SmartEconomics: Economics for Middle School™

SmartEconomics: Economics for Middle School™ is a digital course that empowers middle school students to analyze the economy and identify factors that impact the price of consumer goods. Through a story-based narrative and interactive exercises, students learn to make real-life decisions that require the understanding of key economic concepts. Request access to FutureSmart today and get access to SmartEconomics as well!

Free Course

Key pillars for a strong financial foundation.

Access and accountability.

Students can take lessons anytime, anywhere, with built-in assessments and real-time grading.

Turnkey lessons.

Skills are presented in an interactive, fail-safe environment. Teachers receive lesson plans, activities and discussion guides.

Implementation support.

Our regional team provides on-demand training and professional learning events, guiding you every step of the way.

These EVERFI courses are free.

And they’ll stay free.

EVERFI courses are supported by a network of strategic partners with multi-year contracts—ensuring that teachers, schools and districts can launch these programs, or even write them into the curriculum.

It tied right in with a career unit I taught in my 6th grade technology class & the kids loved it!

TeacherFayetteville R-III School District, Missouri

I like that it was ready-to-use, user-friendly and incorporated both fun and learning, real-life skills.

TeacherComsewogue School District, New York

Frequently Asked Questions

The MassMutual Foundation has partnered with EVERFI to fund FutureSmart for your school or district. Through this multi-year commitment, the MassMutual Foundation provides all middle school teachers and administrators the assurance that FutureSmart can be launched at scale and even written into the curriculum.

FutureSmart's lessons are aligned to Jump$tart Coalition’s National Standards for K-12 Personal Finance Education, National Curriculum Standards for Social Studies, and State Academic Standards. EVERFI provides comprehensive curriculum guides and standards alignment guides to help you plan for implementation.

EVERFI helps teachers, schools, and districts bring real-world skills to students. Thanks to partners, we provide our digital platform, training, and support at no cost.