Build: Credit Fundamentals

Help your students get started on the right path to financial success with a strong credit foundation!

"*" indicates required fields

Get a Headstart - use Build: Credit Fundamentals

Build: Credit Fundamentals is a digital program that helps students build knowledge about acquiring credit, growing credit, managing credit and dealing with fraud or inaccuracies with credit in effective ways. Students will learn to make wise decisions that support their current and future financial well-being, with an emphasis on building and maintaining good credit strategies.

- Understanding Credit

- Growing Credit

- Acquiring Credit

- Managing Credit

- Credit Reporting

Course Snapshot

-

Target Students

Grades 9-12

-

Curriculum

Economics, Finance, Business, or CTE

-

Time

15-20 Minutes/Activity, 1.5 HoursTotal

What’s Credit?

Students will gain an understanding of what credit is and what it means to be creditworthy.

Acquiring Credit

Students will understand the differences between being an authorized user on a credit card, having their own credit card, and having a debit card. Topics include how to apply for a credit card and the fees associated with them.

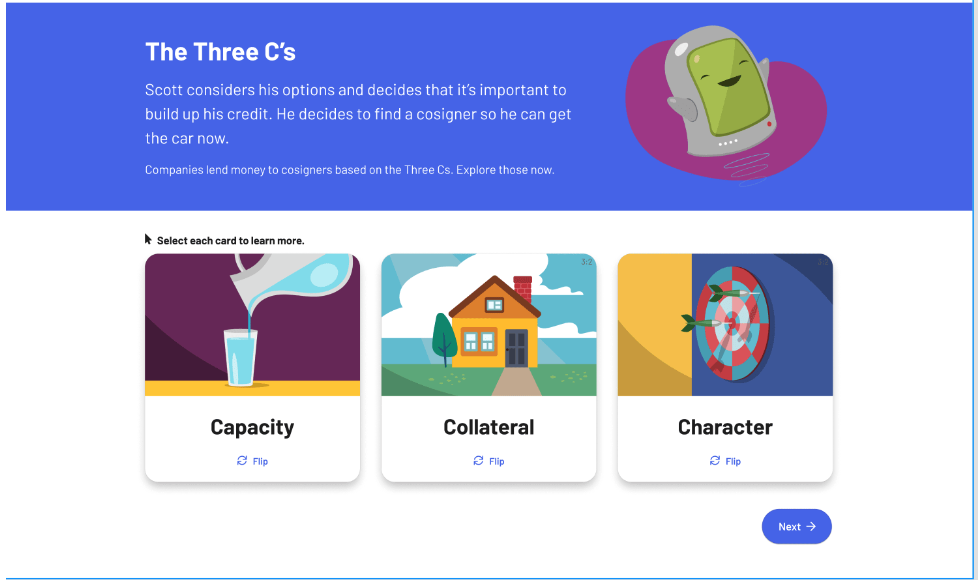

Growing Credit

Students will learn why they may need a cosigner for a loan. Topics such as choosing an appropriate cosigner and how cosigners can help with credit building will be explored.

Addressing Issues with Credit

Students will learn how to recognize identity theft and what steps to take when inaccuracies are identified on a credit report.

Exploring the Key Pillars of EVERFI

Access and Accountability

Asynchronous learning allows for lessons anytime, anywhere with built-in assessments and real-time grading.

Turnkey Lessons

Gamified financial skills in a fail-safe environment. Teachers receive lesson plans, activities, & discussion guides, too.

Implementation Support

Our regional support team guides teachers every step of the way, through on-demand training and professional learning events.

Trusted By 50,000+ Educators Across North America

I think it is important for students to learn about financial literacy and budgeting because these courses teach students real life skills that they are going to need in their everyday life to be successful and survive in the real world.

Gabriel A.High School Teacher, Texas

I like that it was ready-to-use, user-friendly and incorporated both fun and learning, real-life skills.

TeacherComsewogue School District, New York

Frequently Asked Questions

EVERFI has built a network of partners and sponsors who help fund our digital resources for K-12 teachers, schools, and districts. Through multi-year commitments, EVERFI partners like the Truth Initiative give educators the assurance that programming can be launched at scale and even written into the curriculum.

Build: Credit Fundamentals lessons are aligned to National and State Health Education Standards Standards. EVERFI provides comprehensive curriculum guides and standards alignment guides to help you plan for implementation with your middle or high school students.

EVERFI helps teachers, schools, and districts bring real-world skills to students. Thanks to partners, we provide our digital platform, training, and support at no cost.