Join 50k+ educators improving their students' financial literacy with our free program

Our Financial Literacy Topics Include:

- Banking Basics

- Beginning Employment

- Budgeting

- Managing Credit and Debit

- Understanding Insurance

- Planning for College

"*" indicates required fields

Comprehensive Financial Literacy Lessons

EVERFI: Financial Literacy® for High School is a digital education program that teaches students how to make wise financial decisions to promote financial well-being over their lifetime. The interactive lessons in this financial literacy course translate complex financial concepts and help students develop actionable strategies for managing their finances.

Course Snapshot

-

Target Grades

Grades 9-12

-

Curriculum

Economics, Financial Algebra, FCS, Business, AVID, and Advisory

-

Lesson Time

11 digital lessons, 20 min each

Consumer Skills.

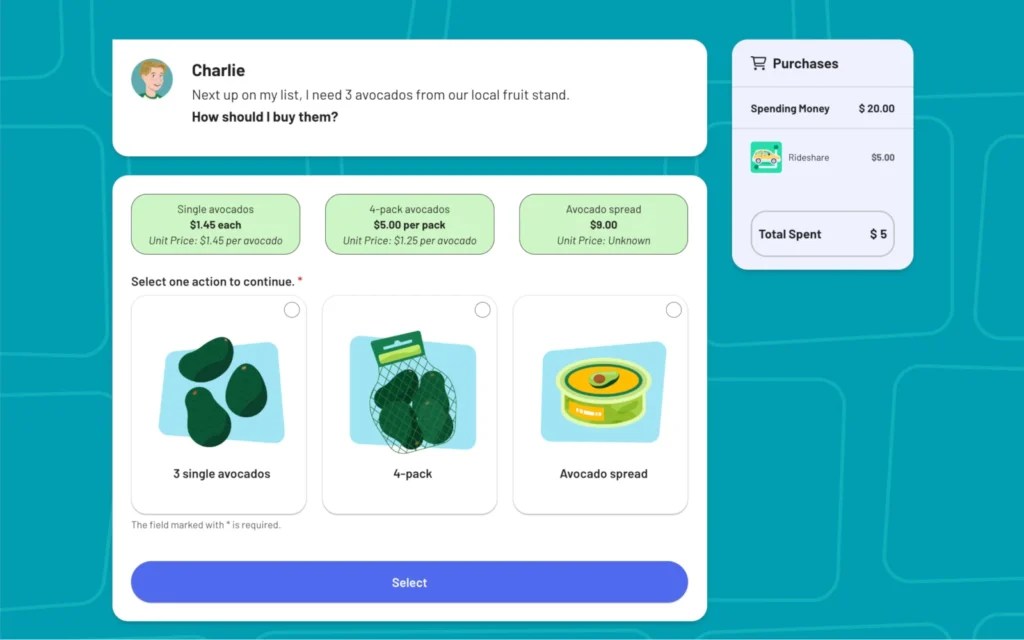

Students gain an understanding of what it means to be a skilled consumer. They also assess the quality of sources when researching products to buy.

Smart Money Habits

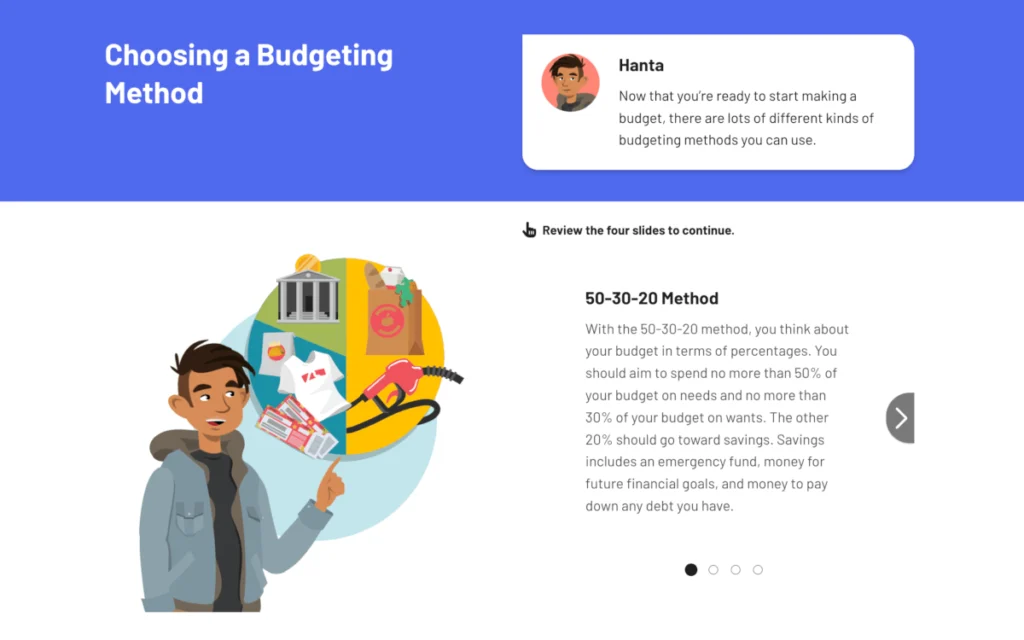

Students identify the benefit of tracking spending and reviewing past purchases. They also practice categorizing items as wants vs. needs and discover budgeting strategies like 50-30-20.

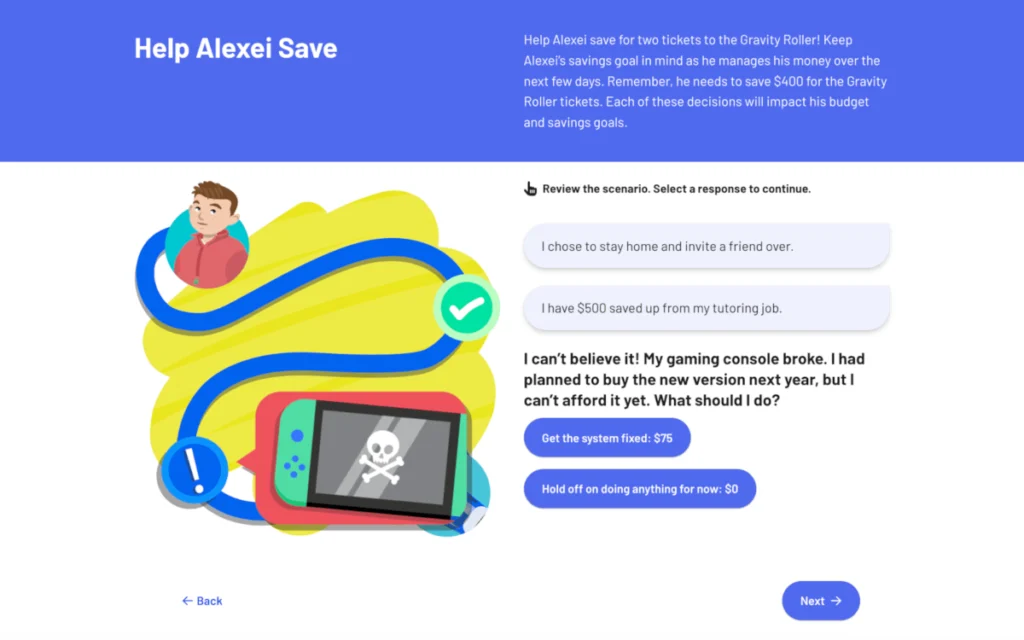

Budgeting

Students describe the reasons for maintaining a budget, identify different types of budgeting methods, and create a budget for prioritizing wants and needs.

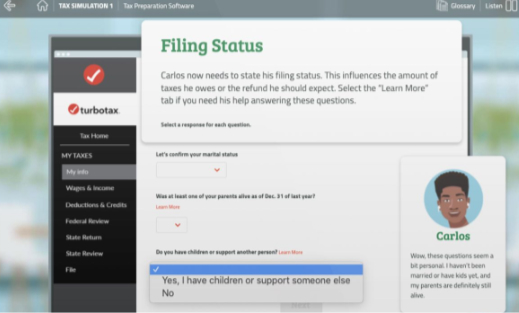

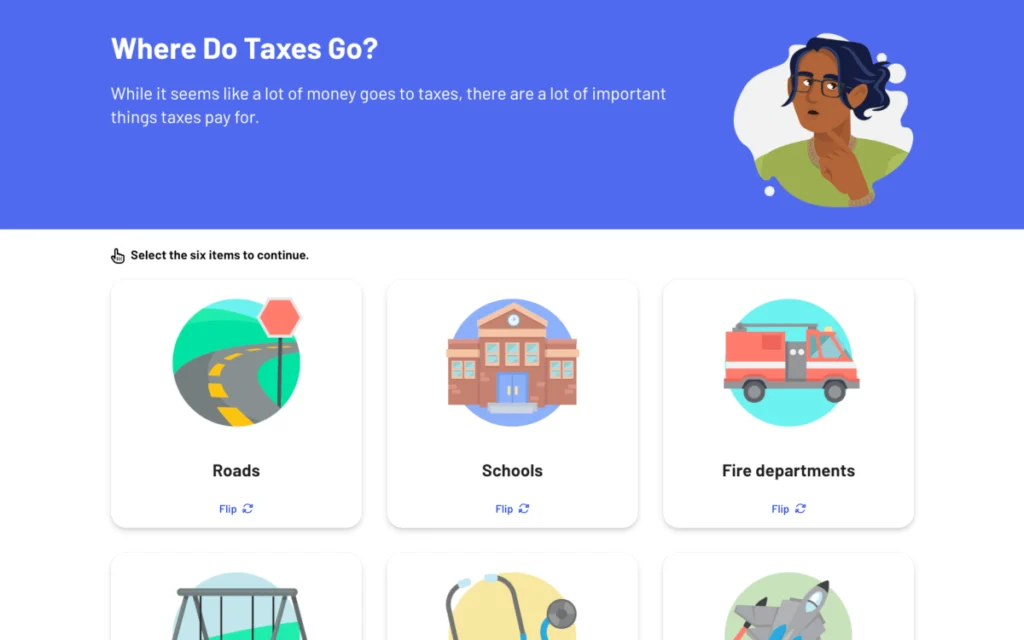

Filing Your Taxes

Students help a character file his taxes electronically and learn how online tax preparation software is helpful, secure, and effective.

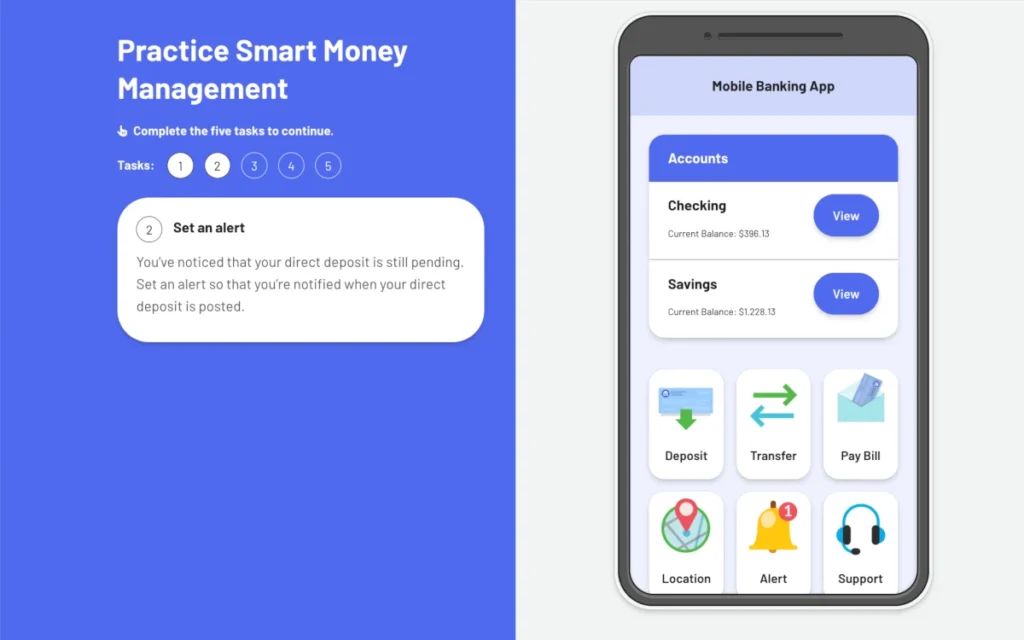

Checking Account

Students explore how to effectively use a checking account and monitor an account balance and spending habits. They also learn about common consumer scams and how to avoid them.

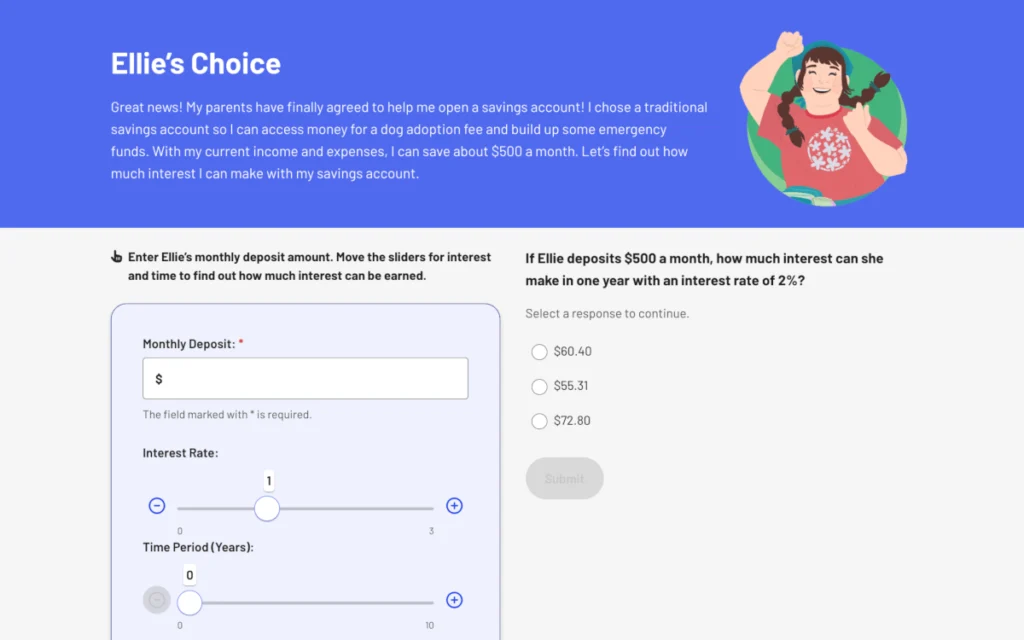

Savings Account

Students learn wise debt management practices and avoid expensive borrowing behaviors. They also explore savings options like savings accounts, money market, and Certificates of Deposit.

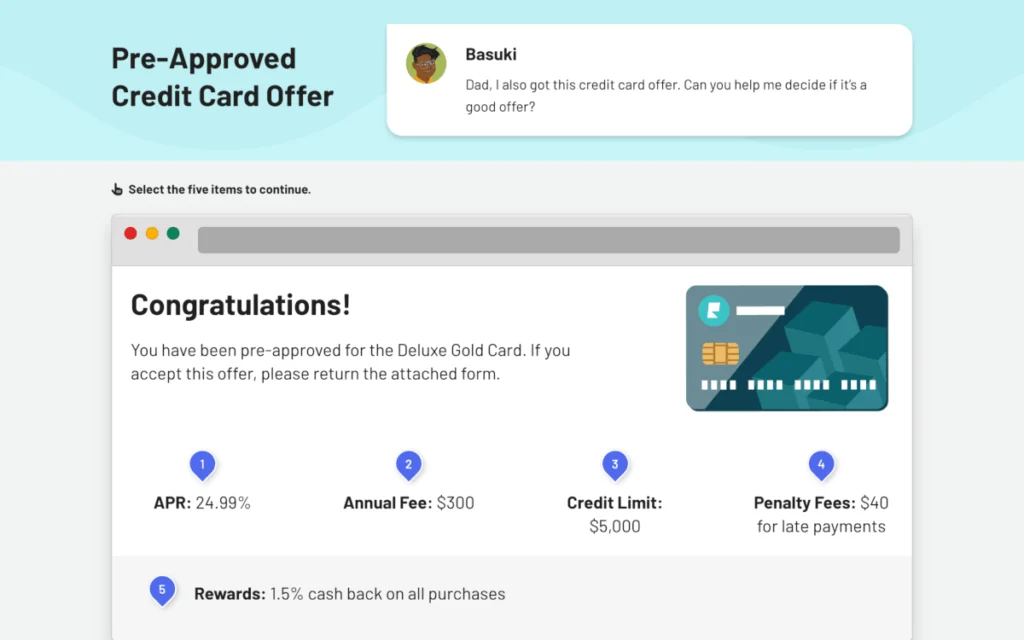

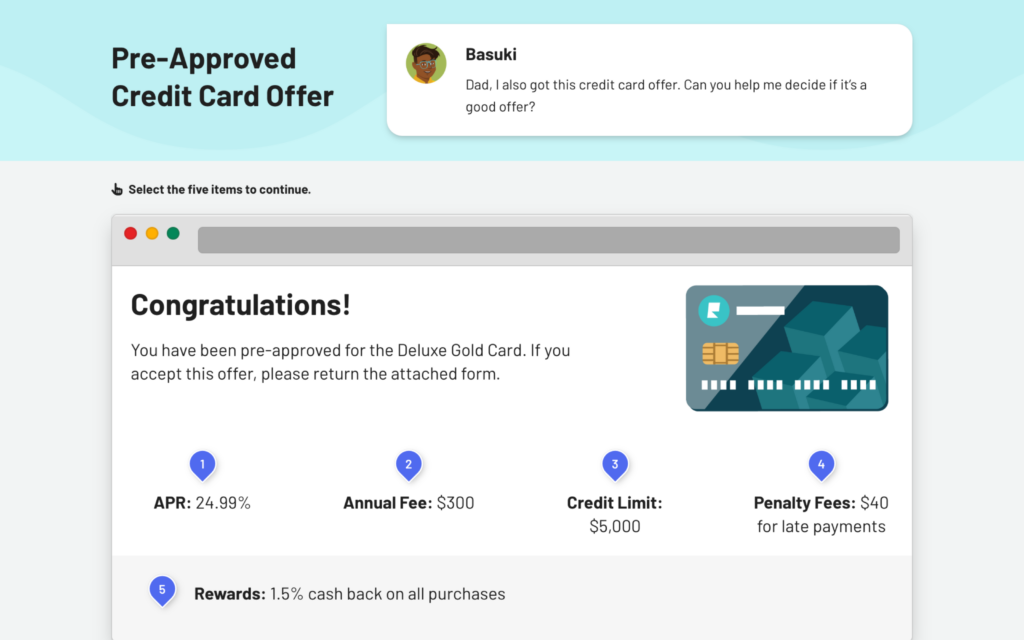

Credit and Debit Basics

Students learn what a loan is and why it is used to finance purchases. They also compare and contrast the differences between secured and unsecured loans.

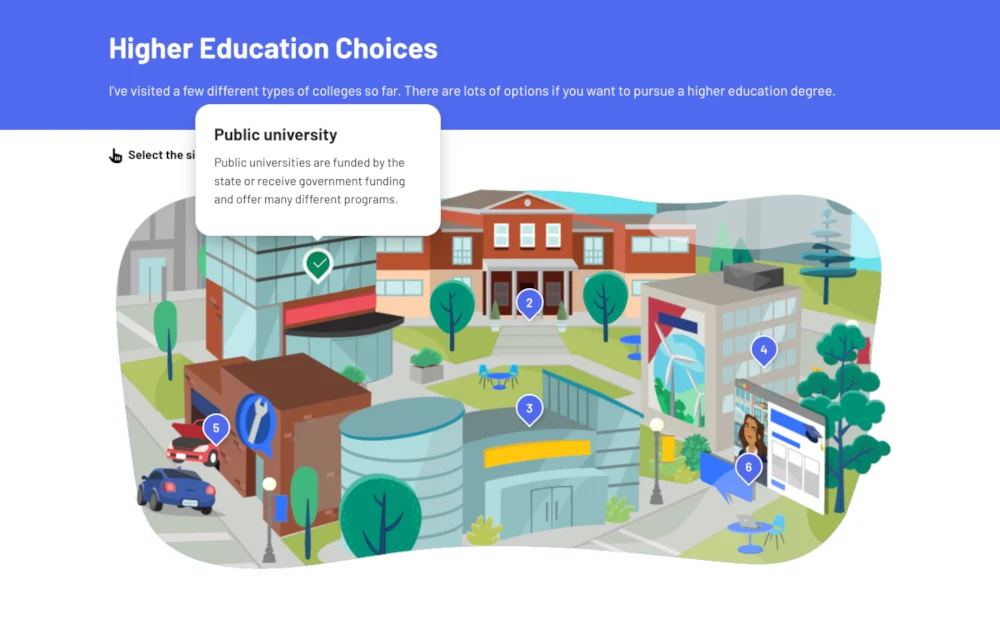

Education ROI

Students discover why higher education typically has a positive return on investment (ROI). They also differentiate the net cost of higher education from the “true cost.”

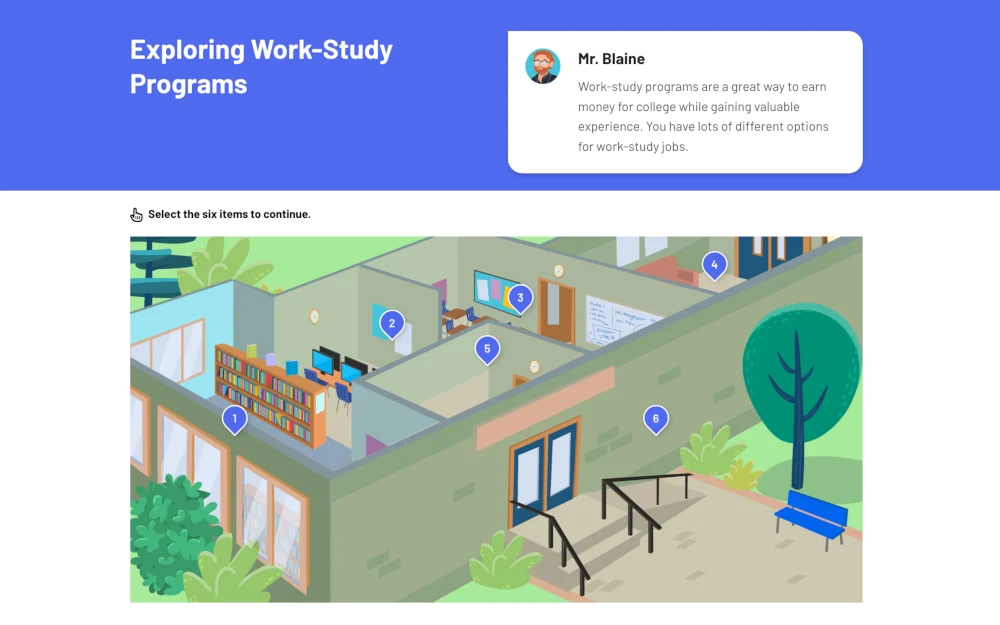

Education and Financial Aid

Students analyze the advantages and disadvantages of various sources of funds for postsecondary education and training. They also learn the importance of submitting a FAFSA.

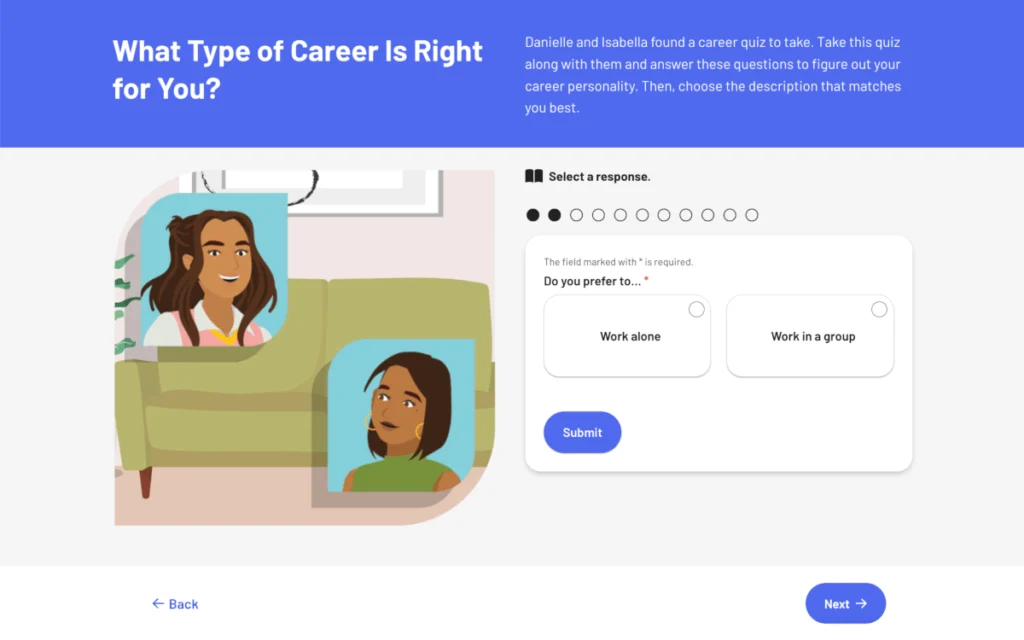

Exploring Jobs and Careers

Students consider career paths, self-employment, education/training, and compensation/benefits as they relate to making career decisions.

Beginning Employment

Students explore the content and purpose of standard tax forms related to starting employment. They also learn the difference between gross, net, and taxable income.

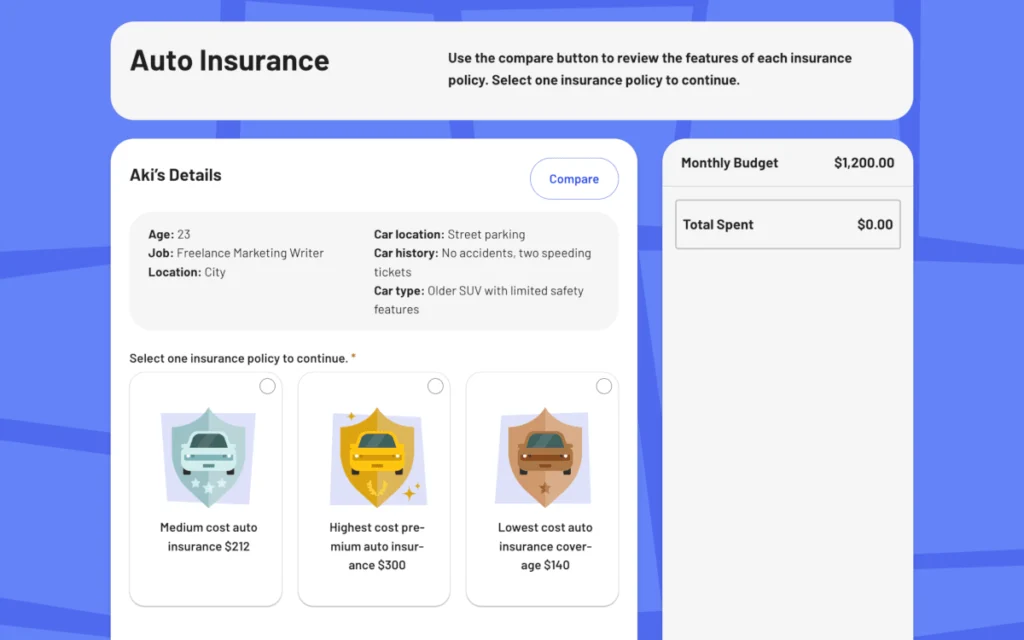

Insurance Basics

Students learn about the need for a risk management strategy and how insurance plays a role. They also compare different types of insurance.

Key pillars for a strong financial foundation.

Access and accountability.

Students can take lessons anytime, anywhere, with built-in assessments and real-time grading.

Turnkey lessons.

Skills are presented in an interactive, fail-safe environment. Teachers receive lesson plans, activities and discussion guides.

Implementation support.

Our regional team provides on-demand training and professional learning events, guiding you every step of the way.

These EVERFI courses are free.

And they’ll stay free.

EVERFI courses are supported by a network of strategic partners with multi-year contracts—ensuring that teachers, schools and districts can launch these programs, or even write them into the curriculum.

I think it is important for students to learn about financial literacy and budgeting because these courses teach students real life skills that they are going to need in their everyday life to be successful and survive in the real world.

Gabriel A.High School Teacher

Texas

This EVERFI course helped me understand the different kinds of ways and methods I can use to set up a budget and stick to it. I now feel confident in understanding how to set up my future financial stability with the knowledge of budgeting I have now.

Seth M.High School Student

Ohio

Frequently Asked Questions

EVERFI has built a network of partners and sponsors who help fund our digital resources for K-12 teachers, schools, and districts. Through multi-year commitments, EVERFI gives educators the assurance that programming can be launched at scale and even written into the curriculum.

These lessons are aligned to National and State ELA Standards. EVERFI provides comprehensive curriculum guides and standards alignment guides to help you plan for implementation with your kindergarten or elementary students.

EVERFI helps teachers, schools, and districts bring real-world skills to students. Thanks to partners, we provide our digital platform, training, and support at no cost.